If you have more than one super account, you may want to consider combining them into one super fund so you pay only one set of fees and charges and you can keep track of your money more easily.

To check your super accounts and find any lost or ATO-held super, you can register at the ATO for their online services and use SuperSeeker. If you have more than one account and wish to consolidate them, you can also request a transfer from one account to another online.

Before making a decision to transfer your super, the ATO recommends you:

You can transfer or roll over your super at any time, with some limited exceptions. Your old super fund will generally process your transfer request within 3 working days of receiving it and has 30 days to make the transfer which starts once you’ve provided the fund with the information it needs. Once your transfer request is completed, your old super fund will send you a rollover benefits statement. Check that it is correct and retain it for your records.

SuperSeeker will only allow transfers of whole balances of super accounts to another super fund. If you wish to transfer only a part of your super account balance, contact your super fund to find out how.

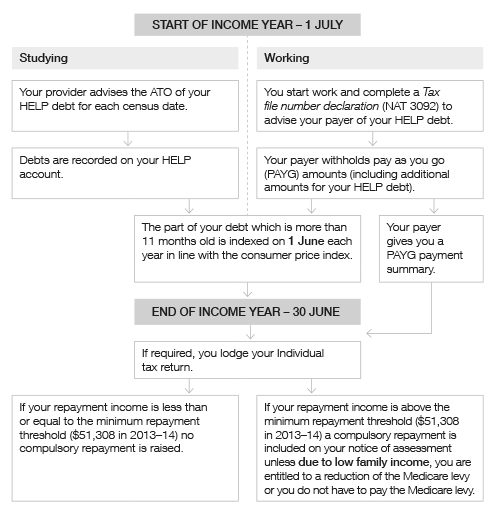

The HECS-HELP upfront discount (10%) and the HELP voluntary repayment bonus (5%) will continue for the time being as the legislation to implement the 2013–2014 Budget changes to the HECS-HELP program, to take effect from 1 January 2014, has not been passed by the Senate.

This means that, until further notice, if you pay off your debt or make a voluntary repayment of $500 or more, you will still receive a discount of 10% or bonus of 5%. The bonus is 5% of the value of the payment made, not 5% of the outstanding debt. You will not receive a bonus on repayment amounts that exceed the balance of your HELP account.

REPAYING YOUR HELP DEBT 2013–2014

This year the Australian Taxation Office (ATO) are paying particular attention to a range of industries and occupations including:

The ATO focus on occupations that have a pattern of large or rising work-related expense claims and on work-related expense claims that did not fit the pattern of a particular occupation.

The ATO are looking closely at overnight travel expense claims as well as claims for transporting bulky tools and equipment. Building and construction workers are incorrectly claiming travel expenses for driving to work. Travel between home and workplace cannot normally be claimed. The travel expense is only deductible if it can be shown that an employer requires a worker to carry bulky equipment in their vehicle as part of their job and that there is no alternative storage solution at the workplace. If the employer does provide secure storage, then the deduction cannot be claimed.

The ATO is also looking at work expenses claimed incorrectly by sales and marketing managers for mobile phone calls based on the time spent at work rather than on work-related use.

Make sure you have incurred the work-related expense in the year you are claiming it, the deduction is allowable and where required, have the appropriate records (e.g. invoices, receipts, log books and/or diary information) to substantiate your work related expense claims.

From 1 July 2014, the Medicare levy will increase from 1.5% to 2% of taxable income for the 2014-2015 income year and later years. The money raised from the increase will be placed into a National Disability Insurance Scheme fund (Disability Care Australia).

This increase will also mean consequential changes for legislation that reference the Medicare levy rate. You may be affected if you are:

INDIVIDUAL INCOME THRESHOLDS

If your taxable income is equal to or less than your lower threshold amount, you do not have to pay the Medicare levy. If you’re taxable income is greater than your lower threshold and less than or equal to your upper threshold amounts, you pay only part of the Medicare levy:

WHAT IS DISABILITY CARE?

From 1 July 2019, the scheme will support more than 400,000 Australians with a disability, their families and carers. It will help pay for carers, to give parents of children with a disability a break. It will help pay for new wheelchairs tailored to individual needs. It will fund home modifications to help people with a disability move around easier. It will fund early intervention services children, like physiotherapy and speech pathology. The increase to the Medicare levy equates to an extra dollar a day for an average income earner. The change would collect $20 billion in its first five years.

Receive FREE information and advice on Accounting & Taxation every Quarter

Signup