Newsletter

Reduced Super Concessions for High Income Earners and Division 293

- Monday, 01 September 2014 06:16

From 1 July 2012, individuals with income greater than $300,000 will have the tax concession on their contributions reduced from 30% to 15% (excluding the Medicare levy) and may be liable to pay Division 293 tax.

The Government has introduced this measure to make the superannuation system fairer by reducing the higher tax concession that very high income earners receive on their concessional contributions, to align it more closely with the concession received by average income earners. This reform will only reduce the tax concession which very high income earners receive on their contributions into superannuation.

The definition of 'income' for the purpose of this measure will include taxable income, concessional superannuation contributions, adjusted fringe benefits, total net investment loss, target foreign income, tax-free government pensions and benefits, less child support.

Concessional contributions' for the purpose of this measure include all employer contributions (both superannuation guarantee and salary sacrifice contributions) and personal contributions for which a deduction has been claimed. For members of defined benefit funds (both funded and unfunded schemes), it will include all of their notional employer contributions.

If an individual’s income for surcharge purposes and low-tax contributions are greater than $300,000, they may have to pay an extra 15% tax on their Division 293 taxable contributions. Taxable contributions will be either the low-tax contributions amount or the excess above the $300,000 threshold – whichever is the lower amount.

If an individual's income excluding their concessional contributions is less than the $300,000 threshold, but the inclusion of their concessional contributions pushes them over the threshold, the reduced tax concession will only apply to the part of the contributions that are in excess of the threshold.

For example, someone with income excluding their concessional contributions of $285,000, and concessional contributions of $20,000 (taking their total income to $305,000), would have the reduced tax concession only apply to $5,000 of their contributions.

The reduced tax concession will not apply to concessional contributions which exceed the concessional contributions cap and are therefore subject to ‘excess contributions tax'. These contributions are effectively taxed at the top marginal tax rate and therefore do not receive a tax concession.

To calculate whether an individual has income and low-tax contributions greater than $300,000, the ATO will look at income reported on your income tax return and contributions reported in your member contribution statement (MCS) and/or self-managed superannuation fund (SMSF) annual return.

Division 293 tax notices of assessment will start issuing from early February 2014. The notice of assessment for Division 293 tax will state total earnings for Division 293 tax purposes, taxable contributions and the amount of Division 293 tax (15% of the taxable contributions) that is due and payable by the prescribed due date.

Individuals are responsible for paying their Division 293 tax liability by the due date, which is generally 21 days after the notice of assessment has issued. A release authority will be issued with the notice of assessment. Individuals can choose to use the release authority to have their fund pay the Division 293 tax or they can pay it out of their own pocket.

Key Tax Dates

- Monday, 01 September 2014 06:16

21 APRIL 2014

• March 2014 monthly activity statement except for small business clients who report GST monthly and lodge electronically using a registered agent.

28 APRIL 2014

• Super guarantee contributions for Quarter 3 (January – March 2014) are to be made to the fund by this date. Employers who do not pay minimum super contributions for Quarter 3 by this date must pay the super guarantee charge and lodge a Superannuation guarantee charge statement - quarterly (NAT 9599) with the ATO by 28 May 2014. Remember, the super guarantee charge is not tax deductible.

15 MAY 2014

• Income tax returns for the 2013 financial year for all other entities that did not have to lodge earlier and are not eligible for the 5 June 2014 concession. Due date for lodging and due date for company and super funds to pay where required. Individuals and trusts in this category to pay as per their notice of assessment.

21 MAY 2014

• April 2014 monthly activity statement - due date for lodgement and payment.

• Final date for appointing a tax agent for a fringe benefits tax role. You must tell us by this date to make sure you receive the lodgement and payment concessions for fringe benefits tax returns.

26 MAY 2014

• Quarter 3 activity statements (January - March 2014) - due date for lodgement and payment (all lodgement methods).

28 MAY 2014

• Superannuation guarantee charge (SGC) statement - quarterly and paying the super guarantee charge for Quarter 3 (January – March 2014), if the employer did not pay enough contributions on time.

5 JUNE 2014

• Income tax return lodgement for the 2013 financial year, including companies and super funds where the return is not required earlier and both of the following criteria are met: non-taxable or refund as per latest year lodged and non–taxable or receiving a refund in the current year. This is for all entities with a lodgement end date of 15 May 2014, excluding large/medium business taxpayers. Income tax returns due for individuals and trusts with a lodgement end date of 15 May 2014 provided they also pay any liability due by this date. This is not a lodgement end date but a concessional arrangement where you will not have to pay failure to lodge on time (FTL) penalties if you lodge and pay by this date.

21 JUNE 2014

• May 2014 monthly activity statement – due date for lodgement and payment.

30 JUNE 2014

• Last day for appointing a registered agent for an activity statement role. You must tell us by this date to make sure your Quarter 4 activity statements are linked to us.

• Super guarantee contributions must be paid by this date to qualify for a tax deduction in the 2013–14 financial year.

Transferring Your Super into One Account

- Monday, 01 September 2014 06:16

If you have more than one super account, you may want to consider combining them into one super fund so you pay only one set of fees and charges and you can keep track of your money more easily.

To check your super accounts and find any lost or ATO-held super, you can register at the ATO for their online services and use SuperSeeker. If you have more than one account and wish to consolidate them, you can also request a transfer from one account to another online.

Before making a decision to transfer your super, the ATO recommends you:

- ask your super fund if there are any fees or charges for, or benefits affected by, rolling your money over to another fund; and

- speak with a qualified financial adviser.

You can transfer or roll over your super at any time, with some limited exceptions. Your old super fund will generally process your transfer request within 3 working days of receiving it and has 30 days to make the transfer which starts once you’ve provided the fund with the information it needs. Once your transfer request is completed, your old super fund will send you a rollover benefits statement. Check that it is correct and retain it for your records.

SuperSeeker will only allow transfers of whole balances of super accounts to another super fund. If you wish to transfer only a part of your super account balance, contact your super fund to find out how.

HECS-HELP Upfront Discount and HELP Voluntary Repayment Bonus

- Monday, 01 September 2014 06:16

The HECS-HELP upfront discount (10%) and the HELP voluntary repayment bonus (5%) will continue for the time being as the legislation to implement the 2013–2014 Budget changes to the HECS-HELP program, to take effect from 1 January 2014, has not been passed by the Senate.

This means that, until further notice, if you pay off your debt or make a voluntary repayment of $500 or more, you will still receive a discount of 10% or bonus of 5%. The bonus is 5% of the value of the payment made, not 5% of the outstanding debt. You will not receive a bonus on repayment amounts that exceed the balance of your HELP account.

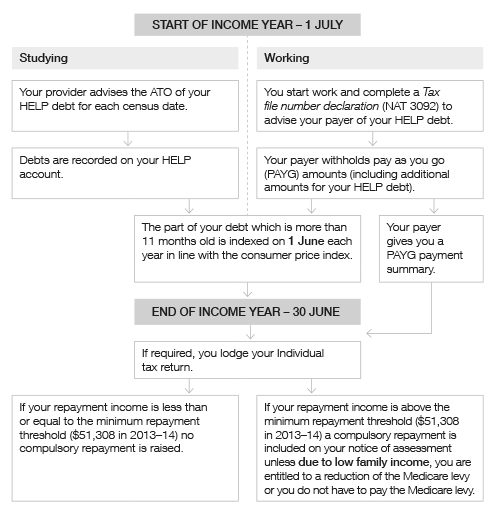

REPAYING YOUR HELP DEBT 2013–2014

Newsletter Signup

Receive FREE information and advice on Accounting & Taxation every Quarter

SignupArchive

- 4th Quarter 2024 (8)

- 3rd Quarter 2024 (9)

- 2nd Quarter 2024 (9)

- 1st Quarter 2024 (11)

- 4th Quarter 2023 (11)

- 3rd Quarter 2023 (9)

- 2nd Quarter 2023 (7)

- 1st Quarter 2023 (8)

- 4th Quarter 2022 (9)

- 3rd Quarter 2022 (8)

- 2nd Quarter 2022 (10)

- 1st Quarter 2022 (9)

- 4th Quarter 2021 (9)

- 3rd Quarter 2021 (8)

- 2nd Quarter 2021 (9)

- 1st Quarter 2021 (7)

- 4th Quarter 2020 (8)

- COVID-19 STIMULUS NEWSLETTER (8)

- 3rd Quarter 2020 (7)

- 2nd Quarter 2020 (9)

- 1st Quarter 2020 (9)

- 4th Quarter 2019 (8)

- 3rd Quarter 2019 (8)

- 2nd Quarter 2019 (7)

- 1st Quarter 2019 (8)

- 4th Quarter 2018 (7)

- 3rd Quarter 2018 (8)

- 2nd Quarter 2018 (8)

- 1st Quarter 2018 (8)

- 3rd Quarter 2017 (7)

- 2nd Quarter 2017 (7)

- 1st Quarter 2017 (7)

- 4th Quarter 2017 (8)

- 4th Quarter 2016 (7)

- 3rd Quater 2016 (7)

- 2nd Quater 2016 (7)

- 1st Quarter 2016 (8)

- 4th Quarter 2015 (6)

- 3rd Quarter 2015 (6)

- 2nd Quarter 2015 (8)

- 1st Quarter 2015 (6)

- 4th Quarter 2014 (7)

- 3rd Quarter 2014 (8)

- 2nd Quarter 2014 (7)

- 1st Quarter 2014 (8)

- 4th Quarter 2013 (7)

- 3rd Quarter 2013 (6)

- 2nd Quarter 2013 (9)

- 1st Quarter 2013 (8)